Manufacturing overhead is a term used to refer to the indirect costs that are associated with producing products. The product cost in a merchandising company such as a retail toy store is relatively easy to determine.

Accounting Exam Flashcards Quizlet

Barry Inc applies manufacturing overhead to products at a rate of 60 per machine hour.

. In June Barry only worked on one job which it began June 1 purchasing 400000 in materials 75000 of which were indirect on account for use on the job. Depreciation is typically used with fixed assets or tangible assets such as property plant and equipment PPE. Examples of costs that are included in the manufacturing overhead category are as follows.

Measuring product cost for a manufacturing entity though requires a more. Fixed overhead costs include rent mortgage government fees and property taxes. Value of Depreciation 600003 20000.

As per statistical analysis the manufacturing. The residual value is zero. Calculation based on double declining method.

These are costs that can change with production output. Calculate the depreciation expense for the year ended 2019 2020 and 2021 that Ali should report in his income statement. Indirect labor 96600 Maintenance of factory machinery 6000 Factory utilities.

In a manufacturing company these costs are often referred to as nonmanufacturing costs. No Depreciation of Office Equipment is not a manufacturing overhead or production cost View the full answer. And recognized 75000 in factory equipment depreciation and 30000 in office equipment.

Depreciation 10000 0 5 years. Manufacturing overhead also known as factory overhead factory burden production overhead involves a companys manufacturing operations. It includes vendors price charged on the invoice freight cost and other necessary costs to make the inventory available for sale.

This overhead is applied to the units produced within a reporting period. So included in our fixed overhead is 500 of depreciation. Since depreciation and amortization are not typically part of cost of goods soldmeaning theyre not tied directly to productiontheyre not included in gross profit.

This is essentially all overhead that is not included in manufacturing overhead. How these costs are assigned to products has an impact on the measurement of an individual products profitability. To compute the overhead rate divide your monthly overhead costs by your total monthly sales and multiply it by 100.

Click to see full answer. E Depreciation on Office Equipment 5000 f Manufacturing overhead was applied at from ACCT 505 at DeVry University Keller Graduate School of Management. E depreciation on office equipment 5000 f.

So lets assume our variable manufacturing overhead to be 3 per labor hour. Click to see full answer. Lets further assume our monthly fixed manufacturing overhead is 2050 per month.

Manufacturing overhead is all indirect costs incurred during the production process. Ali has a policy of charging depreciation at the rate of 20. Administrative overhead includes those costs not involved in the development or production of goods or services such as the costs of front office administration and sales.

Selling expenses such as sales salaries sales commissions and delivery expense and general and administrative expenses such as office salaries and depreciation on office equipment are all considered period costs. These are basically office expenses that get added to the product in the cost sheet. Book Value 60000.

Utility costs for the factory such as electricity gas water. Manufacturing Overhead Rate Overhead Costs Sales x 100. These costs relate to the factory where production is taking place.

It is a broad category that includes indirect expenses such as materials utilities depreciation and laborTo understand manufacturing overhead it is essential to look at the terms direct labor and indirect labor. Can charge this amount in the accounts each year. It includes the costs incurred in the manufacturing facilities other than the costs of direct materials and direct labor.

Output can also impact shipping costs maintenance situations legal fees and advertising. Depreciation on equipment used in the production process. At Saturn we are committed to expanding and improving our product lines and our overall brandOur main goal is to manufacture top quality rugged reliable overhead hoist and crane equipment at a competitive price.

Depreciation 100000 40000. The treatment of depreciation as an indirect cost is the most common treatment within a business. These items include some operational utilities such as electric gas and trash service.

We constantly strive to meet or exceed the needs and expectations of our clients by providing them excellent products. Course Title ACCT 505. It includes vendors price charged on the invoice freight cost and other necessary costs to make the inventory available for sale.

However depreciation charged on the other equipment other than manufacturing related equipment is still deducted from the gross profit. The company can use the following journal entries for the office equipment depreciation. Actual overhead applied to production.

School DeVry University Keller Graduate School of Management. For our purposes lets assume that the current facility and equipment can handle the budgeted output. Hence manufacturing overhead is referred to as an indirect cost.

Manufacturing overhead is all of the costs that a factory incurs other than direct costs. The amount is then transferred to the Income Statement as an aggregated manufacturing cost. The product cost in a merchandising company such as a retail toy store is relatively easy to determine.

In the production department of a manufacturing company depreciation expense is considered an indirect cost since it is included in factory overhead and then allocated to the units manufactured during a reporting period. Depreciation on factory property plant and equipment. Depreciation Office equipment cost Office equipment salvage value Useful life.

Example 1 Straight Line Method SLM Lets consider the cost of equipment is 100000 and if its life value is 3 years and if its salvage value is 40000 the value of depreciation will be calculated as below. For example if your company has 80000 in monthly manufacturing overhead and 500000 in monthly sales the overhead percentage would be about 16. Manufacturing overhead termed as factory overhead.

Insurance expense 2500 Depreciation expense office equipment 4500 Prepaid insurance factory assets 2000 Prepaid insurance office space 2500 Accumulated depreciation factory machinery 6000 Accumulated depreciation office equipment 4500 k. When calculating manufacturing costs depreciation on the factory equipment is also charged as manufacturing overhead. Ali also bought a computer system at a total cost of 10000 on 1 st January 2019.

Manufacturing overhead often referred to as factory overhead or production overhead refers to all the indirect costs incurred in the factory necessary to run the manufacturing operation while the product is being produced. Manufacturing overhead includes such things as the electricity used to operate the factory equipment depreciation on the factory equipment and building factory supplies and factory personnel other than direct labor. Non-manufacturing costs include expenses related to maintenance printing and stationery depreciation of non-manufacturing equipment like.

Measuring product cost for a manufacturing entity though requires a more.

Solved Data Table Costs Incurred Purchases Of Direct Chegg Com

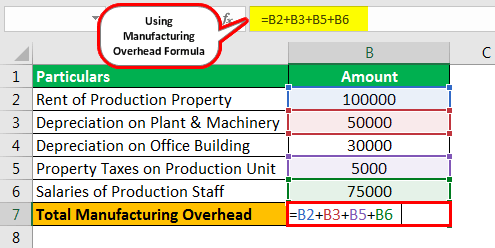

Manufacturing Overhead Formula Step By Step Calculation

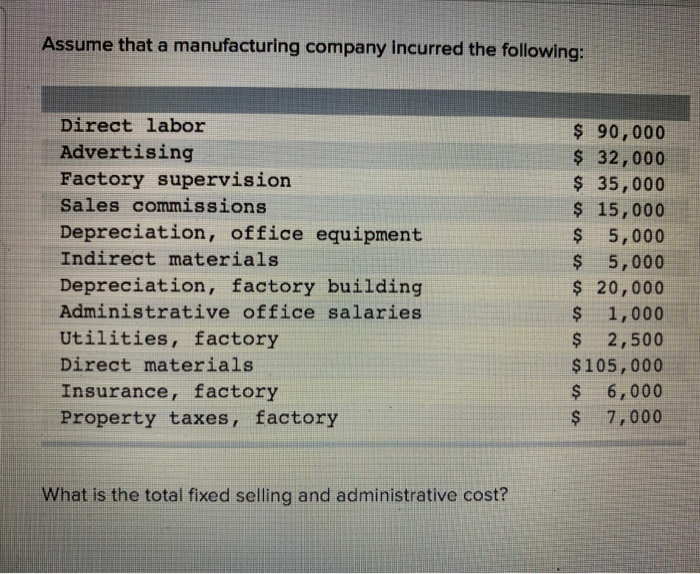

Solved Assume That A Manufacturing Company Incurred The Chegg Com

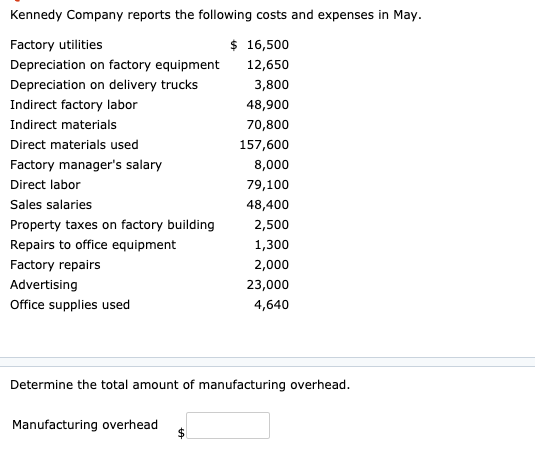

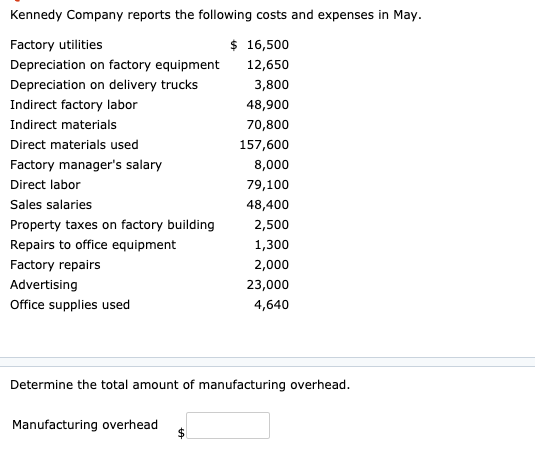

Solved Kennedy Company Reports The Following Costs And Chegg Com

0 Comments